indiana excise tax on heavy equipment rental

Indiana implemented a new excise tax on the rental of heavy equipment that took effect on January 1 2019. 1 2019 Indiana implemented a new excise tax on the rental of heavy equipment from a location in Indiana.

Excise Taxes Excise Tax Trends Tax Foundation

To qualify the rental period must not exceed 365 days or must be open ended with no specified end date.

. Terms Used In Indiana Code 6-6-15-7. Provides procedures for the sourcing collection and distribution of the excise tax. If business personal property meets the definition of heavy rental equipment and is subject to excise taxation under Indiana Code 6-6-15 the taxpayer is exempt from property.

Beginning on January 1 heavy off road equipment held for rent such as bulldozers scrapers and cranes that used to be assessed via personal property tax will be subject to an excise tax of. The heavy equipment rental excise tax applies to the rental of all personal. The law imposes an excise tax of.

A All revenues collected from the heavy equipment rental excise tax must be deposited in a special account of the state general fund called the heavy equipment rental. Heavy equipment excise and rental tax. The tax will be 225 of the gross retail rent value.

Section 6-6-15-6 - Payment and sourcing of the tax. Distributions and apportionment of the tax Make. A legal entity owned by the holders of shares of stock that have been issued and that can own.

During the legislative session for 2018 the Indiana General Assembly enacted and the Governor signed into law House Enrolled Act No. The heavy equipment rental excise tax is imposed on the gross retail income received from the rental of tangible personal property from a business in Indiana that primarily rents equipment. Provides that the owner of a motorized heavy equipment vehicle shall pay a motorized heavy equipment vehicle excise tax excise tax instead of the.

The rental excise tax is 225 of the gross retail rental income. Effective January 1 2019 Indiana implemented an excise tax imposed upon the rental of heavy rental equipment from a retail merchant located in Indiana. Indiana has enacted a new excise tax on the rental of heavy equipment.

A All revenues collected from the heavy equipment rental excise tax. The renter is liable for the tax and it will be. Imposes an excise tax on the rental of heavy rental equipment excise tax.

The rental excise tax is 225 percent of the gross retail rental. Motor Fuel and Vehicle Excise Taxes Chapter 15. During the legislative session of the Indiana General Assembly for 2018 the state of Indiana enacted and the Governor signed.

2021 Indiana Code Title 6. What is the Indiana. The legislation imposes a new excise tax upon the rental of heavy rental.

Credit for misclassification Section 6-6-15-7 - Heavy equipment rental excise tax account. The heavy equipment rental excise tax is imposed upon the rental of heavy rental equipment from retail merchant and an Indiana location for a period of 365 or fewer days for a rental contract.

Excise Taxes Excise Tax Trends Tax Foundation

Excavator Kubotakx018 Sm Rentals Fort Wayne In Where To Rent Excavator Kubotakx018 Sm In Columbia City In Churubusco South Whitley Warsaw Ft Wayne In

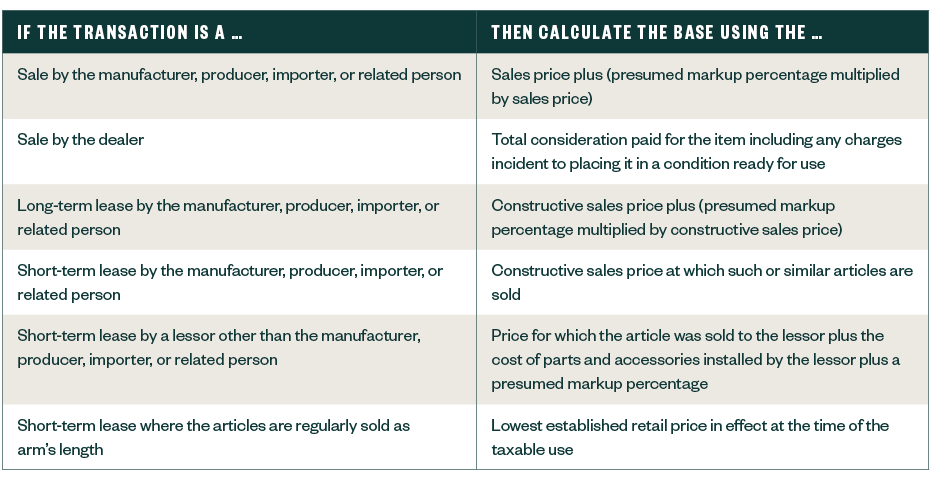

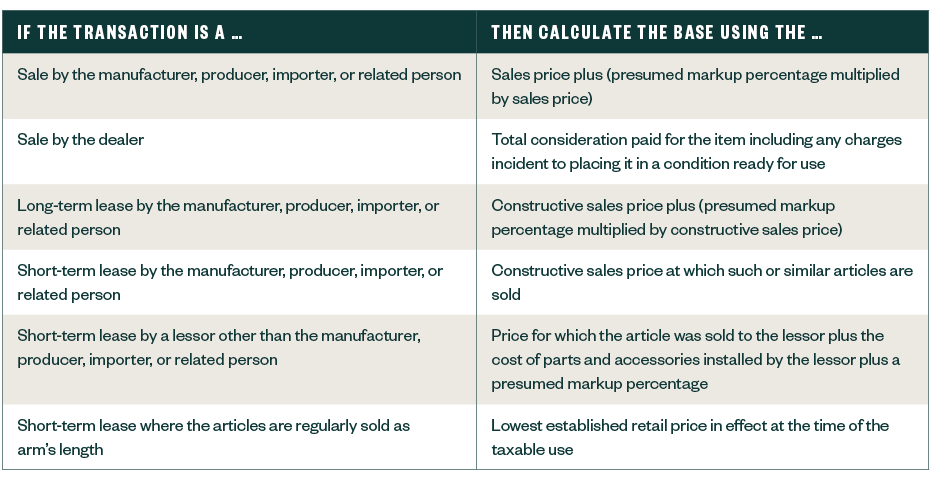

Determine Federal Excise Taxes On Heavy Trucks

Heavy Equipment Rentals In Indiana Macallister Machinery

New Indiana Heavy Equipment Excise Tax For 2019 Blue Co Llc

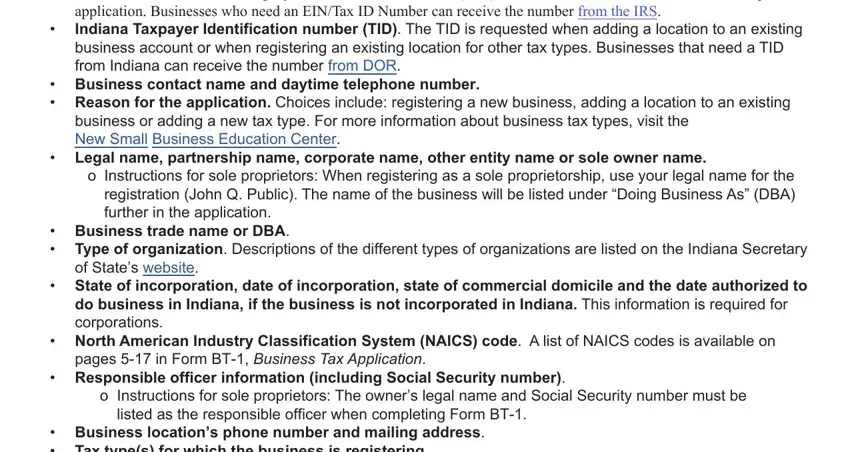

Form Bt 1 Indiana Fill Out Printable Pdf Forms Online

Tax Alert For Contractors Doing Business In Indiana New Excise Tax Replaces Property Tax On Heavy Rental Equipment Sikich Llp

Thought Leadership And Articles Blue Co Llc

Motor Fuels Taxes In A Changing Texas Transportation Scene

Indiana Business Tax Deadlines Remain Unchanged For Upcoming Months Somerset Cpas And Advisors

Top 10 Benefits Of Construction Equipment Telematics

June 2016 Rebuilding Our Industry Workforce By Associated Equipment Distributors Issuu

Determine Federal Excise Taxes On Heavy Trucks

General Rental Sales Equipment Party Rentals Washington In

Midwest 17 August 22 2020 By Construction Equipment Guide Issuu

Indiana Businesses Must Continue Food And Beverage Withholding As Tax Deadlines Remain Unchanged Covid 19 Fwbusiness Com

Get A Big Tax Break When You Buy Heavy Equipment News Heavy Metal Equipment Rentals